|

Analytical information |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

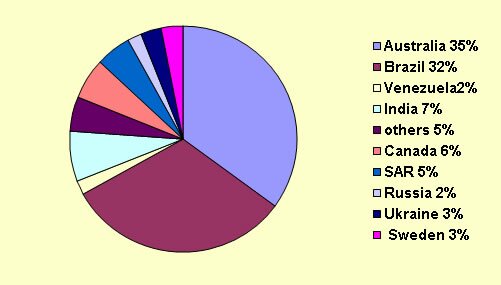

Perspective Development of Iron Ore Mining in Ukraine According to the world experts, the demand for and prices on iron ore will be increasing annually. It is connected with the iron ore shortage at the world market, which, according to the prognosis of the experts in the field, will have been done away with by 2007-2008. But before that time the resources will be in short supply. Immediately after the increase in the world prices, Ukraine is expected to increase prices and the year 2004 clearly proved this. To what extent will the market processes affect our country, which holds one of the leading positions in the world as for the quality of iron ore? Will our iron ore mining industry be able to meet the increasing demands of the metallurgical industry? Ukraine among the Ten Major Iron Ore Producing Countries The world iron ore resources are estimated at more than 213, 42 billion tons. The extensive proven deposits (more than 3 billion tons) are located in 11 countries: Russia, Ukraine, Australia, USA, Canada, Brazil, China, Kazakhstan, India, South African Republic, and Sweden. These countries account for 79, 7 %( 170, 1 billion tons) of the world proven iron ore reserves. Together with Venezuela they dominate the total world iron ore production (92, 2%). Trendsetters in the Price Policy The three largest companies play a leading role in the price policy. They are CVRD (Brazil), Rio Tinto and BHP (Australia). Together they make up 70- 80% of the world iron ore market. The iron ore market is very concentrated. 9 countries account for 95% of the world export. The iron ore market is considered to be extremely stable- the main change over the last ten years has been a decrease in Ukraine and Russia shares in the world export. It has reduced from 9% to 5%. During this period of time the total share of Brazil and Australia has increased by 10% (up to 67% of the world export). Iron Ore Deficit is a Phenomenon in History This is the first time in history that the world market has experienced deficit in iron ore. The main factor that caused it was the overgrowing demand for imported iron ore in China. In 2001, the Chinese government removed a restriction on the construction of new steel plants. Since then, the purchase of ore has been increased more than twice and reached 148 mln tons in 2003. The real state of things has surpassed all expectations. More than 208 million tons has been supplied to this country over recent years. Domestic iron ore reserves in China are big enough but they don’t meet the demands of the national metallurgy industry. Steel production in China has increased by more than 23% in 2004 and amounted to 272, 5 million tons. That’s why the Chinese companies rapidly buy iron ore all over the world they don’t stop before making contracts on purchase of 1-2 million tons from such non-traditional iron ore suppliers as Viet Nam, Peru, Mexico, and Liberia. The Chinese iron ore purchasers have appeared at the iron ore market of the CIS countries. Iron ore deposits, Fe content in them and iron ore production

Shares of the main exporting countries in the world iron ore export

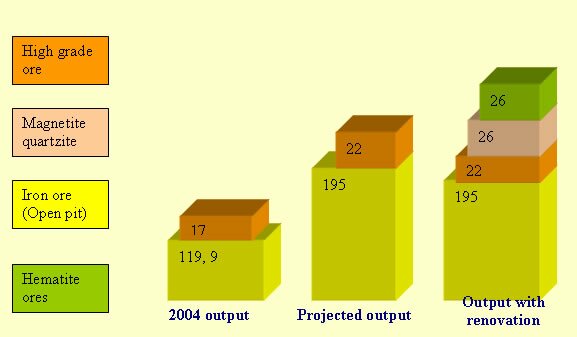

As the western analysts point out, the demand for iron ore in China may decrease this year. Firstly, the consumers need to use the reserves which have been stored. Secondly, they are going to start exploration of a number of new iron ore deposits. But the whole world will feel the consequences of 2004 for a long time. The result of this deficit is an unprecedented increase in prices of iron ore in the Asian Pacific region. The leading exporting countries have already announced about their plans to increase prices by 50-90% in comparison with 2004. Ukraine is Not China In Ukraine, unlike Chinese People’s Republic, the mineral resource industry has more than enough production capacity. Today, in our country the mines which are in operation have the iron ore balance of more than 800 million tons of high-grade ores; and iron ore quartzite amount at nearly 12 billion tons. The basis of iron ore resources is mainly comprised by Kryvyi Rih iron ore basin. It consists of such open joint stock companies as “Kryvyi Rih Iron Ore Complex” with the underground extraction 8, 377,000 tons per year, and the balanced reserves 300 million tons; “Sukha Balka”- with the annual output 3,5 million tons and the balanced reserves 220 million tons; Mining enterprise “Krivorizhstal” with the annual output 1, 473,000 tons and balanced reserves 130, 5 million tons; “Zaporizhsky Iron Ore Complex”, which produces 4 million tons of high-grade iron ore annually and has balanced reserves 177 million tons. Apart from these enterprises, there are six mining and concentration complexes, which are also part of Kryvyi Rih iron ore basin; they extract low - grade magnetite quartzite from open pits and concentrate it to 65 % Fe content. Among them are such open joint stock companies as “Inguletsky GOK” with the annual output of magnetite quartzite 34,5 million tons, concentrate production 13,7 million tons and balanced resources more than 1 billion tons at one enterprise; “Pivdenny GOK” with the annual iron ore production 18 million tons, concentrate 8 million tons and balanced reserves 1 billion 800 million; “Mining and Concentration Complex of “Kryvorizhstal” with balanced reserves 3,5 billion tons, annual iron ore production 15,6 million tons and concentrate 6,8 million tons; “Tsentralny GOK” the balanced reserves of which comprise nearly 370 million tons, annual production of magnetite quartzite is more than 12 million tons and concentrate more than 5 million tons; “Pivnichny GOK with the annual iron ore output 21,5 million tons, concentrate 9,5 million tons and balanced reserves 2 billion tons “Poltavsky GOK”, which produces 23 million tons of iron ore annually, concentrate 7,5 million tons and has balanced reserves 1 billion 670 million tons. It is worth noting that in Kryvyi Rih iron ore basin there are dormant mines which were in operation earlier. They are “Pershotravveva,” “Artem,”and “Gigant” mines; their total reserve balance of magnetite quartzite is nearly 2 billion tons. The iron ore in Kryvyi Rih basin is composed of both magnetite and hematite ores, there is more than 1, 5 million tons of hematite in the interior of the earth and 365 million tons are stockpiled. (Tables 2, 3). With adequate investments, modernization and reconstruction of production facilities, one can increase the output of magnetite quartzite in open pits from 120 million tons to 200 million tons. The output of high-grade has to be increased from 17 to 22 million tons (Diagram 2). As for the surface mining, the technological equipment, which is now being used in the mining and metallurgical complex of Ukraine, differs greatly from the one which is used in highly-industrialized countries of the world. In order to increase the volume of production, it is critical to introduce new explosives, drilling schemes, and to enhance the efficiency of mining. The underground mining is another topic for discussion. The iron ore production with this type of mining instead of moving forward is moving back to “the stone age.” Moreover it happens in geometric progression. For example, mining equipment at Kryvbasruda Association has not been modernized for 20 years. The term of exploitation of stationary mining machines has already expired. Almost all the mining equipment is outdated and completely worn out. However, there were times when Kryvbass used to have the most modern machinery for drilling (Intersol-Rand), transportation (Kawasaki) and mobile loaders. I would like to mention that the administrators of “ Kryvorizky “Iron Ore Mining Complex are planning to work on modernization. However, the time is lost and at present huge investments are needed and they are needed promptly. Besides that, the effectiveness of production can be achieved by means of using high technologies. The technological advancement may be possible due to utilizing combined surface-underground mining technologies (Patent#4686, E21C41/00. Method of Combined Surface and Underground Mining of Iron Ore Deposits). This system provides for high level of production and safety in surface mining. The underground mining must be used for enhancing the efficiency of the open pit. In my opinion, further development of Pershotravnevyi open pit is impossible without its integrating with the underground mine “Pershotravneva #1”. At present, the surface mining there has gone too deep. At the same time, the shafts of Pershotravneva mine, which were closed a few years ago, can be used for this purpose. Consequently, this enterprise will have a better perspective for iron ore production. Sources of procurement and the amount of hematite quartzite intended for GOKOR

The Dynamics of the Probable Iron Ore Production Increase, million tons per year

The Paradox of the Situation Now in Ukraine, a country which has one of the richest iron ore deposits in the world, it is becoming more and more difficult to supply the steel plants with domestic iron ore whereas the total annual iron ore output capacity is 67 million tons and the demand of Ukrainian steel producers equaled 46, 674 tons in 2004. There are two reasons for that. Firstly, the owners of iron ore mines find it more lucrative to export iron ore materials. (Last year the export reached 20 million tons of crude iron ore). For instance, such enterprises as “Poltavsky GOK” and “Zaporizky GOK” export almost all iron ore being produced. Secondly, some domestic mining- metallurgical complexes, having vast deposits, use their production potential to satisfy their own needs. The merge of mining and metallurgical enterprises, which has taken place over the last few years, had a positive impact. As an example, Novokryvorizky GOK before integration with Kryvorizhstal complex didn’t use to have such good technological development, which it has now. Kirov mine before privatization was on the list of the companies to be closed down. Though these mines can double their production capacities, they develop their mining operations adequately to their own needs in iron ore resources.

At present, it is crucial to go through all the production capacities of mining enterprises and solve this problem on mutual conditions. For instance, an enterprise that requires additional iron ore resources should invest into development of mining industry. That’s why it is necessary to undertake probably not popular but vigorous measures concerning the mining and concentration complex of hematite ores, which is located in Dolynska district of Dnipropetrovsk region, the construction of which started in 1980s. At that time such countries as Romania, Germany and Czechoslovakia invested into the construction of this plant. The project called for the usage of advanced for that time technologies and equipment, electric-powered separators with the highest magnetic field, which would have enabled to recover Fe from low-grade ores. The problem of stockpiles was thought to be solved, and, at the same time, it would have made possible to reduce occupied spaces. The idea per se is phenomenal, and its realization would have enabled to solve a number of acute problems in the region. However, the exploration of hematite ore stockpiles of Kryvbass showed that the ores had not been stored selectively and, therefore, their usage at GOKOR was impossible. Then the decision was made to build the entry trench to the quarry of Novokryvorizky Mining and Concentration Complex, which is rich in hematite ores. In other words, it was necessary to extract this ore but not to clear the spaces occupied by the stockpiles of hematite ores, which is not the same. The collapse of the Soviet Union hampered the solution of this problem. The funding of the project stopped when the object was 95% complete, and the countries that participated in the joint construction refused from further cooperation. Today, this enterprise with enormous projected capacity is not operating. The state budget allots money annually on its maintenance but the enterprise doesn’t produce anything. So it’s a waste of state budget funds. What impedes the construction and putting this complex into operation? Aren’t there any proven deposits of hematite ore? No one can prove the opposite. The natural resources of hematite ore will be enough for several generations of people. Their balanced deposits are estimated at 5 billion tons, and nearly 200 million tons have been stored selectively. It is difficult to take into consideration the legal property interests of the former foreign investors. This problem exists but it is not the major one. The Ukrainian government will solve this problem in the near future. The most difficult problem is that our country doesn’t have a reliable technology of beneficiation of hematite ores. The scheme which was projected for that mining and concentration complex is outdated now and the equipment which is more than 15 years now doesn’t meet the modern standards. Substantial work on upgrading the technological chain of iron ore beneficiation may be required. For this purpose, it is necessary to study the international experience in this field of mining production, and to recruit the leading foreign companies for the audit of projected technology and working out a new modern system of beneficiation of hematite. At present, GOKOR looks like this: a pile of metal, foundations, and the roof. From the point of view of economics, maybe it is more lucrative for the country to build a new concentration plant for hematite. But this means a construction of a new complex. The reserves of Kamysh-Burunsk mining complex are also impressive (more than 200 million tons). But these ores are of sedimentary origin and have to lie underground for a few millions of years to develop into metamorphic rocks. At present, they contain so many detrimental inclusions that our technologies are unable to extract. It is worth noting that the adequate use of this type of ore is the world problem. Thus, I can conclude that Ukraine is one of the leading countries in the amount of iron ore deposits. Ukrainian iron ore producers have every opportunity as well as a great potential of engineering and technical personnel to meet all the demands of metallurgical industry. But the prerequisite for a stable and impetuous development is competent and sound government industrial policy. But for the time being, the Ukrainians will have to import iron ore from other countries. So the market economy laws dictate their conditions and maybe we should thank the businessmen for finding ways of supplying our metallurgical enterprises with iron ore raw materials. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Head of the State Committee of Safety and Health at Work,

Since the coal became the strategic resource of the industrial development, the safety of coal miners at work places became the strategy of the state policy. The deeper the coal miners had to work, the more significant the problem of safety became. Because in case of the accidents (the methane explosion and fires), the cost of the coal mines’ renovation appears to be very high. The History of the establishment of the Committee of Health and Safety at Work of Ukraine After the collapse of the Soviet Union, the administration reform that took place in Ukraine created the inspections on the supervision of the labour safety of the high risk objects in mining industry. The number of qualified workers though was reduced. In this way the state and society showed their unawareness of the importance of the labour safety. The Department of Labour Safety within the structure of the Ministry of Social Policy of Ukraine did not have powers to prevent all the accidents that took place at that time in Ukraine, and in this way it was not responsible for some very important and necessary issues of labour safety. The work of the Department was not about how to prevent the accidents, but mostly was about the explanation of the tragedies that happened. Only after the fatal accident at “Barakov mine” in 2000, when 80 miners died, the draft laws on the improvement of labour safety inspections were given. That enabled to provide every mine with the inspector of labour safety. But that was mostly about the regional policy and did not raise public awareness of the necessity to create the state supervision of the labour safety. The first significant step was after the creation of the Committee of Health and Safety at Work of Ukraine in September 2002. Main problems The main problems of the safety in mining industry are the unsatisfactory conditions of the mines’ funds, the imperfection of the technologies, the depth of the mining (more than 14 % of the mines are working below 1 km), and the lack of financial support of the research in the mining labour safety sphere. In this regard, the issue of productivity and efficiency of the mines should go hand in hand with the labour safety supervision. Because every year more than 300 miners die from the fatal accidents and more than 12000 miners suffer from industrial diseases. One of the examples that proves the possibility to reduce the level of fatalities and shows the effectiveness of the work is in the United States of America, where the level of the injured in mining industry is not higher than in other industries. For example, the West Virginia’s coal mine “Consol” was a success due to having no fatalities during 9 months and producing 3, 5 mln tones of coal. The methane explosion But still the biggest enemy of the miners is the methane gas. During the last 10 years, 38 explosions of dust and gas took place in Ukrainian mines. The average level of degasation is only 17% of coal mines. The technology of degasation may appear to be cost-ineffective, but putting it to the industrial producing will become profitable. The example of the US’ experience was one of the issues of the mutual cooperation with Ukraine. The project of the cooperation included the supply of the mines with the rock dusters in order to prevent the coal dust explosions and fires. The negotiations on the issue of the supply of the drilling technologies are being held. The suggestion to the Ukrainian Government in this view would be the creation of the motivation for the foreign investors to work in Ukraine. The issue of the social support of the injured In the sphere of the social support of the injured in the coal mining industry, the Fund of the social insurance of the industrial injuries and work diseases of Ukraine does pay to those who are injured or suffer from industrial diseases, but what about the problem of the prevention, the reasons of the diseases? The issue of the ownership of the coal mines This may sound strange but until now the problem of property in Ukraine has not been settled. This is obvious and evident that the enterprise and safety can’t be well and efficiently governed until the owner knows that he is the real owner and understands his responsibility for the people who are working. The suggested ways out • The installation of the modern technologies providing health and safety at work together with the high level of efficiency coal mining industry. • The reduction of the miners’ staff, introducing the automatic technologies instead. • The closing of the inefficient miners and social insurance of the unclaimed workers (miners). • The development of the liquid mines. • The financial support of qualified personnel. • The financial support within the country and motivation of the foreign investors. • The strategic supervision over the issue of labour safety by the regional inspectors and raising public awareness about the importance of the health and safety at work at the national level. All the above – mentioned ways out will definitely change the situation of safety at work for the better which will prove that if the source (people, coal) is of a great importance, the state is bound to put it forward as the strategy of its public policy. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Dynamics of the industrial injury in districts (2002)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The statistical analysis of the industrial traumatism |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||